- The 10x Factors

- Posts

- The Two-Day, Six-Trillion-Dollar Wipeout

The Two-Day, Six-Trillion-Dollar Wipeout

A 10x Lesson On The Tariff War — And 3 Options To Protect Yourself Financially

Trump announced "Reciprocal Tariffs" on April 2, 2025, during a speech he referred to as "Liberation Day." The policy includes a universal 10% tariff on all imports of goods into the US, with higher rates for specific countries.

Those specific countries include China at 34%, the European Union at 20%, and Vietnam at 46%.

The baseline tariffs of 10% were set to take effect on April 5, 2025, while the country-specific tariffs were scheduled to begin on April 9, 2025.

The next day, on April 3, the Dow Jones plunged 1,679 points (4%).

The following day, China announced retaliatory tariffs on all US imports on April 4, also at 34%, plus restrictions on rare earth exports and added several US companies to its trade sanctions list.

In response to this news, the Dow Jones plunged a further 2,231 points (5.5%).

This is a total plunge of 3,900+ points in just 2 days — wiping out a whopping $6 trillion dollars from the stock market.

Why do tariffs have this huge effect on the stock market?

It depends on the amount of tariffs imposed, and on the countries they’re imposed on.

If the tariff amount is, say, 10%, some importers might not increase their prices and would absorb it if they could, which would mean a lower profit, but they would be able to retain market share.

Or they could pass it down to their consumers who might not mind a 10% increase.

But if the amount is much higher at 20% or more, the importer would most likely pass it on to their consumers who would either buy a cheaper alternative, or not buy their products altogether.

This then would affect the importer’s earnings — and stock prices reflect what their investors expect the importer to earn in the future. If earnings are expected to fall, stock prices usually fall too.

But wait, there’s more.

If the tariffs are imposed on a major trading partner — like China — the impact spreads across multiple sectors. Companies that rely on Chinese parts or manufacturing will see costs rise, their products become more expensive, and their top line earnings will be significantly reduced.

Not only that, because of China’s retaliatory tariffs, US companies exporting to China will find it harder to sell their products there.

The price of a company’s stock is tied to its earnings. Apple, for example, produces its iPhones in China. It imports iPhones into the US market. Since the US has imposed a 34% tariff on goods imported from China, this means Americans’ next iPhone will soon be at least 34% more expensive.

Would Apple’s profits start to decrease in the months ahead? This is likely as probably fewer people would be upgrading to the company’s latest and greatest model, unlike in years past.

In addition, China has its own home grown brands for equally-capable smartphones like Huawei, Oppo and more. If Chinese consumers shift more and more to their own brands either due cheaper prices or nationalistic fervour, Apple could lose significant market share in China — one of its biggest overseas markets with 42.9 million iPhones sold in 2024.

Investors are not sitting around to find out, so they cash out first. Apple’s share price has dropped about 16% since April 2.

And we’re just at the beginning of the tariff wars.

Remember, Trump has another 3 years to go in his current term. And he has indicated he would want to stay on for a third term even though the 22nd Amendment of the US constitution restricts him to just 2 terms as president (8 years total). Do you think he would be giving up the presidency when his current term ends, or finding ways to stay on beyond what he is allowed by the constitution?

Nobody knows for sure, although we all have a nagging feeling which option he’ll choose.

So stocks will be up for some very rocky rides ahead. Although a good way to get really wealthy is to buy top stocks when they’re tanking and cashing out years later once they have recovered. But nobody knows what the bottom is currently as the tariff wars are just starting.

So what are your alternatives, as an investor?

Here are 3 you may want to consider:

Gold

When markets get volatile — like during a tariff war — investors often shift their money into assets they trust will hold value. Gold is one of the most reliable of these. It doesn’t depend on company profits, interest rates, or trade agreements. Gold isn’t tied to any country’s exports or corporate earnings. It doesn’t suffer from higher import costs. So it avoids the direct hit that stocks or company-linked assets might face during a trade conflict.

Gold has a track record of holding its value — or even gaining — during global tensions, financial crises, and inflationary periods. Trade wars often bring a mix of all three.

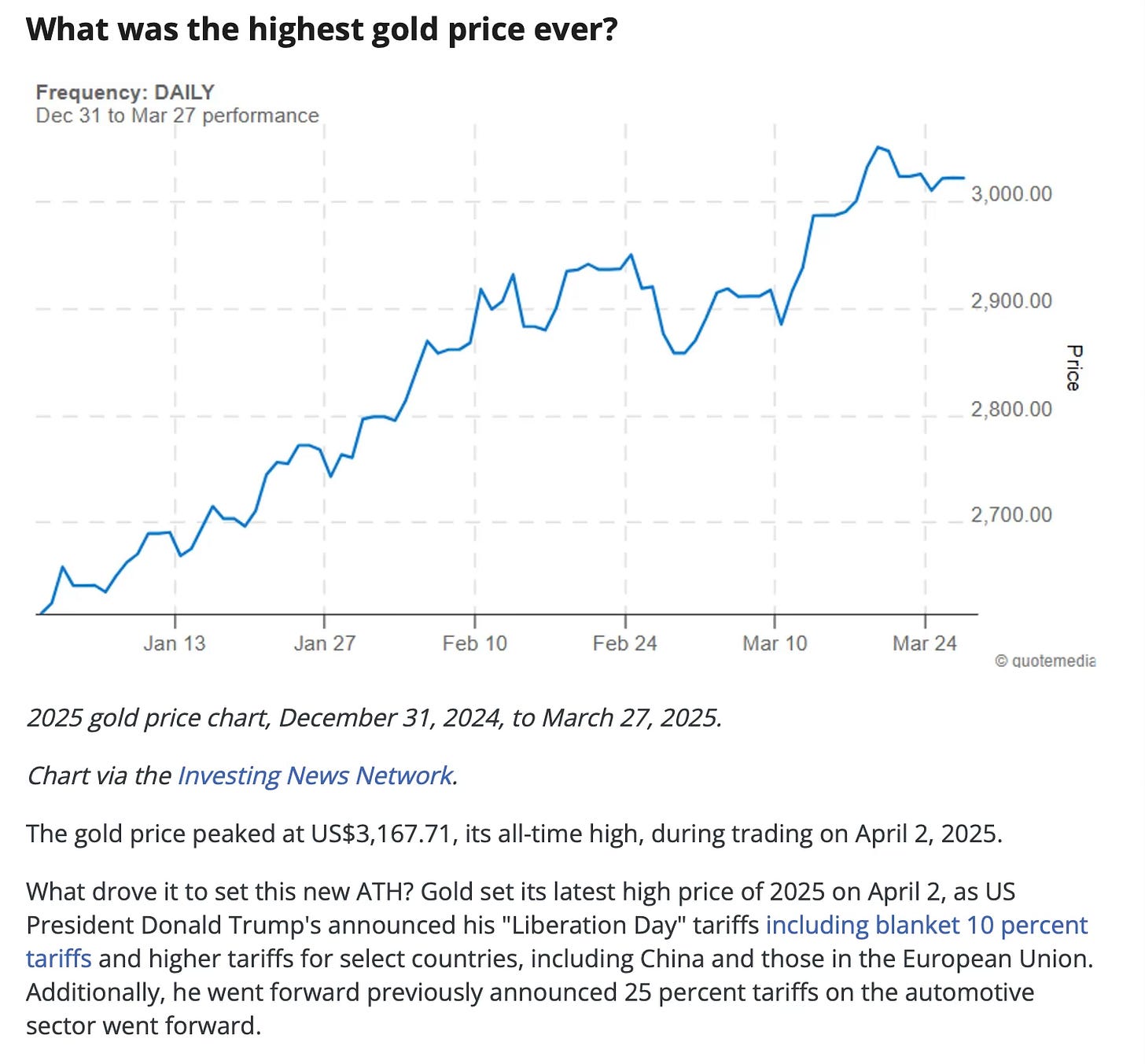

In fact, Gold reached its highest-ever price of $3,167.71 an ounce on April 2, (remember “Liberation Day”?):

Bitcoin

Bitcoin isn’t tied to any country, government, or central bank, as it’s decentralised. So when two major economies like the U.S. and China clash, Bitcoin remains outside their direct control. That makes it appealing to those looking to protect wealth from policy-driven risks.

Tariffs apply to physical goods crossing borders. Bitcoin is digital and doesn’t move like goods do. You can send it across the world in minutes, without customs, shipping fees, or import taxes.

While gold focuses on preserving value, Bitcoin offers the chance for price growth, especially during global instability. If people start to fear inflation, currency devaluation, or banking issues, more may turn to Bitcoin — pushing up demand and price.

You don’t have to buy an entire Bitcoin — you can buy a fraction of it, so it doesn’t matter what your budget is.

Go here to get your Bitcoin entirely tax free.Altcoins Trading (Fully Automated)

Bot gold and Bitcoins are held for the long-term. Gold preserves value, while Bitcoin gives you growth.

But while you wait, altcoins (cryptos other than Bitcoin) can give you immediate profits. By immediate, I mean immediately. You can earn profits within hours and oftentimes within minutes from the time you start trading them.

And I don’t mean manually trading them. I mean using AI, automation and clever (and my own proven) strategies to automatically trade them, so that you don’t have to lift a finger to do this.

Altcoins are much more volatile than stocks and even Bitcoin itself. But AI, automation and human strategies come together to take advantage of this volatility so that you can earn short term profits — in many cases, very high short term profits — no matter what the market conditions may be.

These automation and strategies that are built into the automation and AI will simultaneously maximise your profits while minimising your risks at the same time, while also ensuring that you are as hands free as possible.

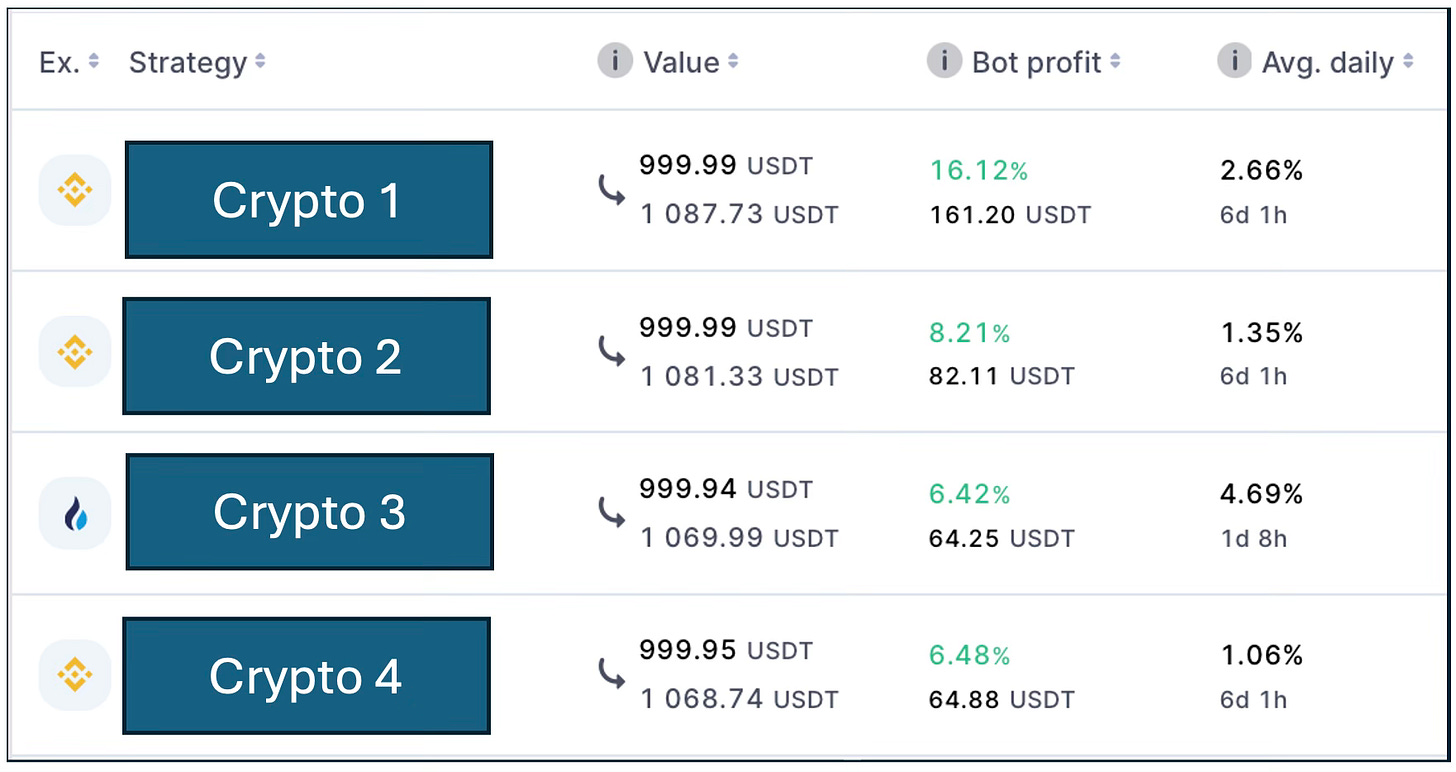

If you know which altcoins are the top performers and how to set up the automation using special software, you may see the following profits within days, like me. My profits average between 1.06% to 4.69% on my capital in a single day:

The automations for each of the 4 cryptos above are just days long. The cryptos’ names are blanked out because if you don’t know how to set up the automation for them and use the right strategies, you will likely lose money.

If you want to know more about this automated trading strategy, click here. Most active traders have no idea this strategy even exists — even though it can cut down their analysis work by 99% and make their trading totally hands free without increasing their risk.

And those are the 3 options you may want to consider, to protect yourself financially while the tariff war plays out.

Until it ends, you can expect more chaos in the months ahead, and more risks to your money unless you take action now to secure it.

Cheers!

NOTE:

The 10x Factors for investors’s content is educational in nature, with examples used to illustrate the learning points. We are not financial advisors and do not provide financial advice. Please speak to your financial advisor before making any investment decision. Note that every investment comes with its own risks and drawbacks. Past results cannot guarantee future returns. Do not invest with money you cannot afford to lose.

This content may contain affiliate links. When you click on these links and make a purchase, we may receive a commission at no additional cost to you. We only promote companies that we have personally used or researched and believe will add value to our readers.

Reply